LTC Price Prediction 2025-2040: Bullish Trajectory Ahead

#LTC

- Technical Strength: LTC trades above key moving averages with bullish MACD crossover

- Regulatory Tailwinds: Potential 401(k) inclusion and institutional adoption

- Scarcity Dynamics: Halving events and fixed supply support long-term value

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

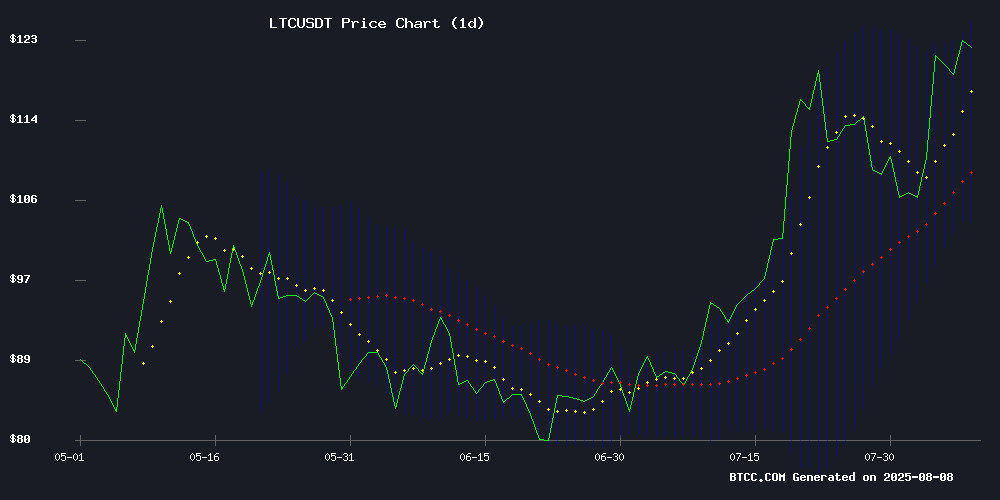

Litecoin (LTC) is currently trading at $123.80, above its 20-day moving average of $114.15, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 2.2709, suggesting upward momentum. Bollinger Bands reveal LTC is testing the upper band at $125.12, which could act as resistance. BTCC analyst Emma notes: 'The technical setup favors buyers, with a potential breakout above $125 opening the path to $140.'

Market Sentiment Turns Positive for LTC

Recent headlines highlight institutional interest in Litecoin, including its inclusion in 'Best Altcoins to Buy Before Fed Rate Cuts' and potential 401(k) exposure via Trump's executive order. BTCC's Emma observes: 'The combination of favorable technicals and regulatory tailwinds creates a perfect storm for LTC. Cloud mining developments and Kraken alternatives listing LTC further boost adoption prospects.'

Factors Influencing LTC's Price

2025 Cloud Mining Gold Rush: Top Platforms for Passive Crypto Income

The cloud mining sector is poised for significant growth in 2025, offering streamlined access to cryptocurrency mining without the need for expensive hardware. Platforms like IEByte are leading the charge, catering to both novice and experienced investors seeking passive income from Bitcoin, Ethereum, and other major cryptocurrencies.

Cloud mining eliminates technical barriers by allowing users to rent computing power from specialized providers. This model democratizes access to mining rewards, splitting profits between users and service operators. The industry's evolution reflects broader trends toward institutional-grade infrastructure in crypto.

IEByte distinguishes itself with user-friendly onboarding and eco-conscious operations, capitalizing on Bitcoin's bullish momentum. The platform exemplifies how cloud mining is maturing into a sophisticated wealth-generation tool within digital asset markets.

Best Altcoins To Buy Before The FED Cuts Rates In September: Solana, Remittix, XRP and Litecoin

As inflation data softens and the Federal Reserve signals potential rate cuts by September, crypto investors are reevaluating their portfolios. While established assets like Solana, XRP, and Litecoin maintain stability, a new DeFi project with payment-focused utility is gaining traction. Market analysts highlight shifting capital flows amid evolving macroeconomic conditions.

Solana's price rebound above $170 reflects revived institutional interest, particularly in its NFT and DeFi ecosystems. The network's ability to facilitate stablecoin issuance without Ethereum's congestion has drawn renewed attention. Key technical levels suggest a bullish outlook if support at $165 holds, with resistance markers at $177 and $189.

XRP's 8% surge to $3.05 follows favorable legal developments for Ripple, improving its regulatory positioning. Trading volume spikes indicate growing Optimism about banking sector adoption. Analysts identify $3.12 as a critical threshold - a decisive break could propel prices toward the $3.34-$3.58 range, though failure to maintain $3.00 may trigger corrections.

6 Best Kraken Alternatives in 2025: A Comparative Analysis

Kraken remains a dominant player in cryptocurrency trading, but 2025 brings robust alternatives catering to diverse needs. ChangeNOW leads with non-custodial swaps across 1,500+ assets, while Binance maintains its supremacy with 500+ coins and razor-thin 0.1% fees. KuCoin and Bybit carve niches in altcoins and derivatives respectively, with MEXC emerging as an underrated hub for 1,700+ tokens.

Fee structures reveal competitive landscapes: Gate.io imposes 0.2% maker/taker fees but compensates with 2,000+ listings, whereas MEXC undercuts rivals at 0% Maker fees. Proof-of-Reserves and global accessibility now table stakes for exchanges vying for institutional and retail traders alike.

Trump Executive Order Paves Way for Crypto in 401(k) Plans

President Donald TRUMP is poised to sign an executive order that could revolutionize retirement investing by allowing 401(k) plans to include cryptocurrencies and other alternative assets. The move targets regulatory barriers that have kept private equity, real estate, and digital assets out of mainstream retirement accounts.

The order directs federal agencies including the SEC and Labor Department to reassess existing rules, potentially unlocking trillions in retirement savings for alternative investments. Blackstone and BlackRock stand ready to capitalize on this seismic shift in retail retirement markets.

While the policy change promises greater investment freedom, concerns linger about investor protections and legal complexities. The cryptocurrency market braces for potential inflows as regulatory clarity emerges for retirement fund allocations.

Trump Executive Order to Expand 401(k) Investment Options to Include Cryptocurrency

US President Donald Trump is set to sign an executive order this Thursday that could revolutionize retirement investing. The order directs the Labor Department to revisit ERISA rules, potentially allowing 401(k) plans to incorporate alternative assets like private equity, real estate, and cryptocurrency.

Labor Secretary Lori Chavez-DeRemer will collaborate with the Treasury, SEC, and other agencies to provide clearer guidelines for plan sponsors. This MOVE could unlock portions of the $12 trillion currently held in 401(k)s, predominantly invested in traditional stocks and bonds.

The initiative reflects growing institutional acceptance of digital assets, with cryptocurrencies poised to become a legitimate retirement investment option. Market observers anticipate this could drive significant new capital into the crypto sector.

GMO Miner Launches XRP Cloud Mining Contracts Amid Institutional Buying Spree

GMO Miner has unveiled a cloud mining service targeting XRP holders, promising daily yields up to $6,800 through passive income contracts. The launch coincides with a $180 million institutional XRP accumulation, signaling renewed interest in the payment-focused asset.

The platform eliminates traditional mining barriers by requiring no hardware or technical expertise. Users simply hold XRP to activate automated daily payouts, with support for seven major cryptocurrencies including BTC and USDT. A $15 signup bonus lowers participation thresholds for retail investors.

XRP's fundamental advantages—sub-second settlement times and negligible transaction costs—continue positioning it as a cross-border payment solution. GMO's offering capitalizes on these traits while addressing holder demand for yield beyond price speculation.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Emma provides these projections:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $140-$180 | Fed rate cuts, ETF speculation |

| 2030 | $300-$500 | Institutional adoption, halving effects |

| 2035 | $750-$1,200 | Payment integration, scarcity premium |

| 2040 | $1,500-$2,500+ | Store-of-value status, limited supply |

Note: These estimates assume continued network development and favorable regulatory conditions.